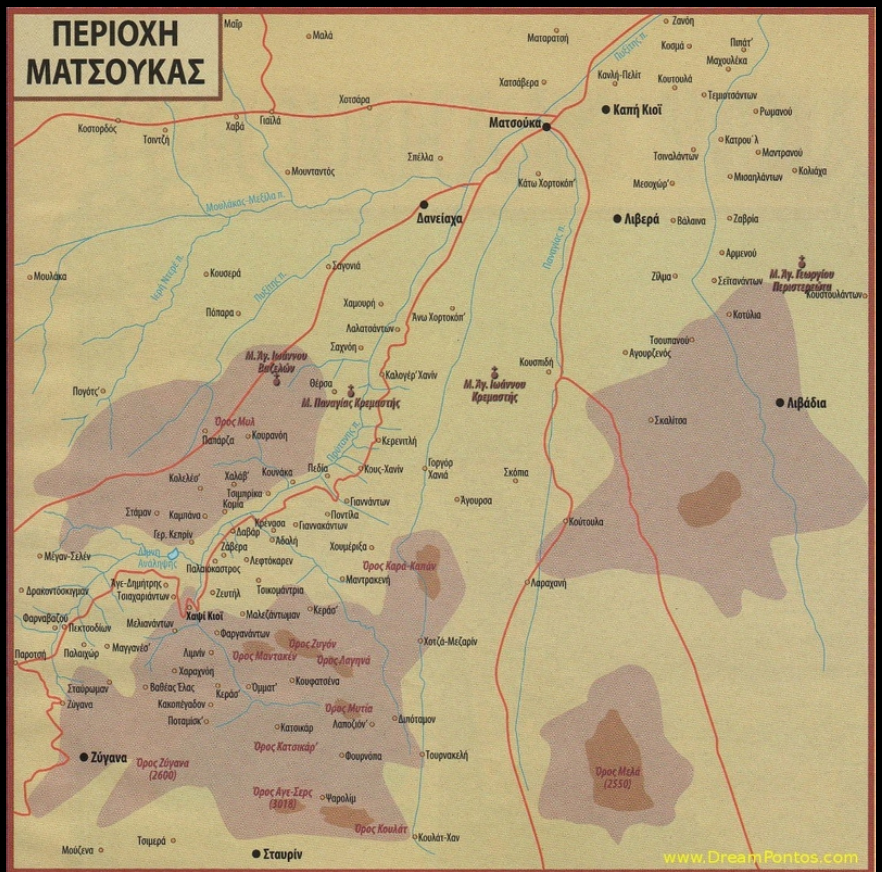

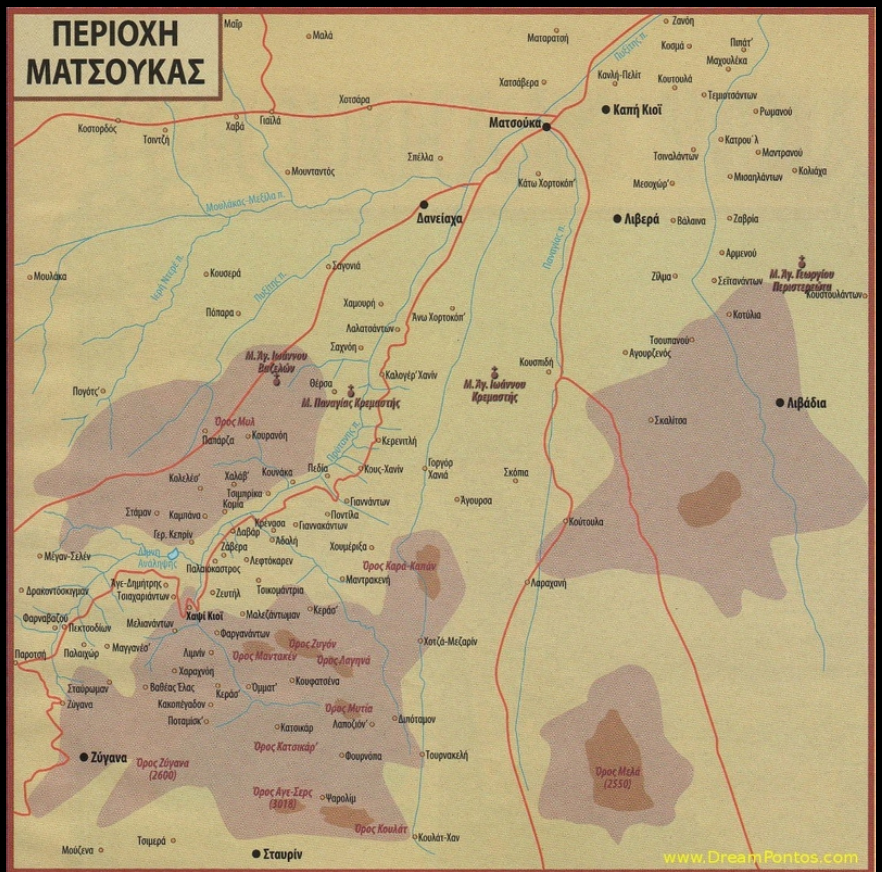

Τα χωριά της Ματσούκας

Το πρώτο χωριό που συναντά κανείς ερχόμενος από Τραπεζούντα είναι το χωρίον Τσαγκάρ ή Ρωμανού το οποίο είχε 40 χριστιανικές οικογένειες, αλλά και δημοτικό σχολείο και ναό τιμώμενο επ' ονόματι του Αγίου Ιωάννη του Χρυσοστόμου. Είχε επίσης και βυζαντινό παρεκκλήσιο τιμώμενο επι των Ειδοσίων της Θεοτόκου.

Κοντά στο χωρίον Τσαγκάρ βρισκόταν ένα άλλο χωριό με το όνομα Πιπάτ (ίσως Υπάτη) όπου βρίσκονταν παλιά ερείπια οικισμού, πιθανά οι εαρινές κατοικίες των αρχόντων της πόλεως (των Κομνηνών). Κατοικείτο από 30 περίπου τουρκικές οικογένειες.

Έτυχε κάποτε να περάσουμε (αναφέρει ο ιερεύς συγγραφέας) απ το τουρκικό αυτό χωριό και καθίσαμε δίπλα σε μια δροσερή πηγή για να δροσιστούμε και να ξαποστάσουμε. Διέκρινα με το μάτι μου στο μέσω ενός αγρού (αγροκηπίου) ένα μεγάλο όγκο που περιβαλλόταν απ όλες τις πλευρές του από σμίλακες αγκαθιών (τα λεγόμενα σμιλάγκια = αγριόχορτα), τα οποία σαν αγκαθωτά σχοινιά έφταναν περίπου σε ύψος 15-20 μέτρα ψηλά, ίσως και περισσότερο.

Από τη μεγάλη του περιέργεια άφησε τους συντρόφους του και πήγε να δει από κοντά αυτόν τον περίεργο όγκο. Βρήκε λοιπόν έναν κήπο στο μέσον του οποίου υπήρχε αυτός ο μέγας όγκος σκεπασμένος από παντού με αγκάθια. Εκεί κοντά βρισκόταν ένα τουρκικό σπίτι.

Ζήτησε πληροφορίες απ τον νοικοκύρη του σπιτιού κι αυτός του είπε ότι είναι "ζιγιαρέτ" δηλαδή προσκύνημα και ότι η οικογένεια του έχει παράδοση από τους προγόνους της να αλετρίσει και να καλλιεργήσει όλο το χωράφι χωρίς να αγγίξει καθόλου τον περίβολο του αγρόκηπου όπου μέσα βρισκόταν το ζιγιαρέτ.

Τον παρακάλεσε να του δώσει μια αξίνα για να κόψει τα αγκάθια και να πλησιάσει όσο το δυνατόν περισσότερο κοντά και να δει περι τίνος πρόκειται. Εκείνος του έδωσε μία κρωπήν (μικρό δρεπάνι, κλαδευτήρι) κι άρχισε να κόβει, να ανοίγει δίοδο από την δυτική πλευρά και προς μεγάλη του χαρά είδε κομψού βυζαντινού παρεκκλησίου. Υπολόγισε το πλάτος στα μέτρα αντίστοιχα.

Πάνω απ τη θύρα του παρεκκλησίου ήταν ζωγραφισμένος απ΄τη μέση και πάνω γυμνός ο άγιος με την επιγραφή " του Αγίου Ιωάννου ". Επρόκειτο μάλλον περί του Αγίου Ιωάννου του Ελεήμονος. Ο θόλος του παρεκκλησίου ήταν πεσμένος. Οι αγιογραφίες άρχιζαν απ΄ τους τοίχους του ιερού βήματος αναπαριστώντας όλο το βίο και τα θαύματα του Κυρίου και συνεχίζοντας μέχρι στης θύρας, με χρώματα τόσο ζωηρά ώστε νόμιζε κανείς ότι αγιογραφήθηκαν μόλις χθές !

Πολύπλοκοι σταυροί χαραγμένοι στις πέτρες και θαυμάσια κιονόκρανα ήταν πεσμένα μέσα στο ναό. Τα κυριότερα τούτων τα μάζεψε ο ιερεύς μέσα στο ιερό βήμα του οποίου ο θόλος δεν κατέρρευσε διότι στηριζόταν εκατέρωθεν από κίονες.

Στην "Ιστορία και στατιστική της Τραπεζούντος" του μακαριστού Σάββα Ιωαννίδη διαβάζουμε ότι η Άννα Κομνηνή, θυγατέρα του τελευταίου Αυτοκράτορος της Τραπεζούντος Δαβίδ Κομνηνού, μετά την άλωσιν της Τραπεζούντος έχουσα εις τα τρίωρον από της Τραπεζούντος επέχοντα κτήματά της εις το χωρίον Τσαγκαρή, Τούρκον υπάλληλον, εχάρισε όλα εις αυτόν, υπο τον όρον να μη εγγίση τον περίβολον του αγροκηπίου εντός του οποίου ευρίσκεται το παρεκκήσιον του Αγίου Ιωάννου κα αυτή απεχώρησε προς την Αργυρούπολιν.

Το χωρίον Τσαγκάρ ούτος το τοποθετεί προς τα Πλάτανα όπου πράγματι βρίσκεται χωρίον με το ίδιο όνομα. Αλλά και το Τσαγκάρ της Γαλίανας σε τρίωρη απόσταση βρίσκεται ομοίως. Τον σεβαστό αυτόν δάσκαλον Σάββαν Ιωαννίδην υπέργηρον τον συνάντησε ο ιερεύς συγγραφέας στην Τραπεζούντα και του ανέφερε τα παραπάνω τονίζοντας ότι κατά πάσα πιθανότητα το αγρόκτημα της Άννας Κομνηνής βρισκόταν εις το Τσαγκαρή της Γαλίανας αφού και το αγροκήπιον και το παρεκκλήσιον σώζεσαι ακόμα. Αλλά εκείνος (Σάββας Ιωαννίδης) δίστασε να εκφέρει γνώμη.

Πολλές βυζαντινές εκκλησίες (ναοί) και παρεκκλήσια υπάρχουν στη Γαλίανα και στη Ματσούκα με αγιογραφίες στους τοίχους, αλλά σε όλες τις τοιχογραφίες αυτές τα μάτια των αγίων είναι βγαλμένα από του Τούρκους, λές και δεν ήθελαν να βλέπουν οι άγιοι τα αίσχη που διέπραξαν οι δαίμονες αυτοί. Μόνο το παρεκκλήσιον αυτό του Αγίου Ιωάννου του Ελεήμονος στη Γαλίανα διασώζει ανέπαφη και ακέραια την αγιογραφία του.

Τρείς ακόμη Βυζαντινοί ναοί υπάρχουν και απέχουν λίγο απ΄τον Διπόταμον, στο χωρίον Τραχιανού (Τραϊανού) εκ των οποίων ο μέν μεσαίος μεγάλος ναός του οποίου ο νάρθηκας αλλά και ο θόλος που έχουν πέσει υποβαστάζονταν υπο τεσσάρων μαρμάρινων κιόνων με μαύρες φλέβες και εκατέρωθεν δύο παρεκκλήσια με τοιχογραφίες των αγίων, το ένα ακέραιο και το άλλο μισοερειπωμένο.

Οι αγιογραφίες έχουν κανονικό φυσικό μέγεθος ενώ οι οφθαλμοί των αγίων είναι εξωρυγμένοι. Λεγόταν ότι ο μεγάλος ναός ετιμάτο επ' ονόματι του Ευαγγελισμού της Θεοτόκου ενώ οι δύο πάνω από 100 οικογένειες μωαμεθανών. Ένας Τούρκος έκτιζε το σπίτι του και κατά την ανασκαφή των θεμελίων βρήκε δύο πίθους (πιθάρια) που περιείχαν κάρβουνα, στάχτη και δόντια, εξ' ού φαίνεται ότι εκεί υπήρχαν άλλοτε ειδωλολατρικοί τάφοι.

Μετά το Κατρούλ συναντάμε το χωρίον Μανδρανόη το οποίο λέγεται ότι ονομάσθηκε έτσι λόγω της χρήσης του ως μάνδρας ποιμνίων και ζώων των προυχόντων Τραπεζουντίων οι οποίοι είχαν εξοχικές επαύλεις στο Πιπάτ και στο Κατρούλ. Το Μανδρανόη κατοικούνταν από 100 και πλέον Ελληνικές οικογένειες. Είχε πλήρες δημοτικό σχολείο και ναό τιμώμενο στη μνήμη του Αγίου Νικολάου. Υπήρχε επίσης ημιερειπωμένο βυζαντινό παρεκκλήσι του Αγίου Θεοδώρου Τήρωνος αλλά και ακόμη ένα εις το Πέδ στην κορυφή του βουνού προς τιμή των αρχιστρατήγων Μιχαήλ και Γαβριήλ επίσης ημιερειπωμένο

Μεταξύ Τσαγκάρ και Μανδρανόης πάνω σε ένα λόφο Προφήτου Ηλιού στο οποίο πήγαιναν προσκυνητές απ΄τη Γαλίανα αλλά και Τούρκοι. Γύρω-γύρω απ' το παρεκκλήσι φύτρωνε άφθονη βάτος κοινώς λεγομένη "χαλκόβατος" με μαλακά αγκάθια σαν σκληρές τρίχες η οποία παρήγαγε πολλά και χοντρά βατόμουρα.

Όσοι προσκυνητές έπασχαν από ασθένειες τοποθετούσαν χαλκόβατα στο πονεμένο μέρος τους επικαλούμενοι τον Άγιο. Έβλεπε κανείς τους προσκυνητές άλλους ως στεφανωμένους με χαλκόβατα άλλους ζωσμένους και άλλους να τα έχουν τυλιγμένα στα χέρια ή τα πόδια.

Απέναντι στην ανατολική πλευρά του Μίλταγη λίγο πιο πάνω απ΄τον ποταμό φαινόταν ακέραιο και ανέπαφο παρεκκλήσιον πάνω σε βράχο που λεγόταν η "Αεσκουλίτσα" ίσως η Αγία Ακυλίνα.

Προχωρώντας απ' τη Μανδρανόη φτάνουμε στο χωρίον Μισαηλάντων. Είχε 50 περίπου Ελληνικές οικογένειες οι άνδρες των οποίων εμπορεύονταν στην Τραπεζούντα. Το Μισαηλάντων είναι η πατρίδα του πρώτου Μητροπολίτη Ροδοπόλεως αειμνήστου Γενναδίου Μισαηλίδου με αρχιερατεία στη Ροδόπολη Πόντου απ' το 1863 ως το 1867.

Στο Μισαηλάντων είχε περικαλλή ναό της Κοιμήσεως της Θεοτόκου και δημοτικό σχολείο και βυζαντινό παρεκκλήσι του Αγίου Βασιλείου ημιερειπωμένου στα όρια του χωρίου Χαρτοματζάντων.

Απ' του Μισαηλάντων και σε απόσταση μισής ώρας πεζοπορίας διερχόμενοι τον "Παλιαλόν" (παλιά αλώνια) φτάνουμε στο χωρίον Ζαβρία ή μάλλον Ζεβρία, διότι παλιότερα υπήρχαν εκεί Αρμένιοι τους οποίους οι Έλληνες ονόμαζαν ζεβρούς (αριστερούς). Είχε κάποτε 40 Ελληνικές οικογένειες. Πάνω απ' το Μισαηλάντων και της Ζαβρίας βρίσκεται το οροπέδιον Πυργή όπου υπήρχαν οικήματα των κατοίκων Μισαηλάντων και χρησίμευαν ως πρώτος εαρινός σταθμός (μεζιρέ) των αγελάδων, όπου μετά της αποχώρηση τους στα ψηλότερα μέρη κατά τα τέλη Μαϊου το χόρτο ηύξανε άφθονο και το οποίο θέριζαν και αποθήκευαν ως χειμερινή τροφή των ζώων.

Εκεί είχε οίκημα και λειβάδια και η Ιερά Μονή Περιστερά και από κει διερχόταν επι Κομνηνών η οδός από Τραπεζούντα εις Παϊπούρτη αλλά και την ενδοχώρα. Το οροπέδιον τούτου κάποιοι έλεγαν ότι καλείται Πύρ-γή, διότι κάποτε ήταν ηφαίστειο. Εμείς όμως ουδεμίαν ενέργειαν του ηφαιστείου ακούσαμε από του παλαιότερους μας. Πάνω στο οροπέδιο υπάρχει ένα κυκλικό βαθύ μέρος έκτασης περίπου ενός χιλιομέτρου με 10 ως 12 μέτρα βάθος μέσα και κάτω απ' την πιφάνεια της γής. Άλλοτε ήταν λίμνη την οποία αποξήραναν οι πατέρες της Μονής Περιστερά κι είχε λιγάκι νερό μόνο προς τις άκρες τις όπου και βούλιαζαν τα ανυποψίαστα ζώα πηγαίνοντας για βοσκή επειδή υπήρχε άφθονο χόρτο. Είχε το όνομα : " Του Δράκ το λιμνίν" και ισχυρίζονταν ότι κάποτε ήταν κρατήρας ηφαιστείου.

Κατά το έτος 1905-1906 μέρα μεσημέρι και ενώ οι κάτοικοι αισθάνθηκαν κανένα σεισμό, λίγο πιο κάτω απ' το Πυργή αποσπάστηκαν κινούμενοι κάτω προς τις πλαγιές του όρους δημιουργώντας τοποθεσία Ζεφοτόν κατέρρευσε ολόκληρο δάσος έκτασης τριών στρεμμάτων κι έφτασε μέχρι την περιοχή της Ζαβρίας όπου και σταμάτησε.

Άλλες πηγές αναφέρουν ότι ονομάζεται Πυργή το συγκεκριμένο όρος μάλλον διότι υπήρχαν εκεί πύργοι για να κατασκοπεύονται τα πέριξ. Απ' το σημείο εκείνο φαίνεται η θάλασσα της Τραπεζούντας και σε ευρεία ακτίνα τα πέριξ όρη. Από κεί φαίνονται και ίχνη ερειπίων στην κορυφή που καλείται "Φλιβερού" ενώ σε άλλη απότομη κορυφή υπάρχει παρεκκλήσι πρόχειρα στημένο χωρίς στέγη προς τιμήν του Αγίου Αποστόλου Παύλου χωρίς να φαίνονται ίχνη άλλου αρχαίου κτιρίου.

Μετά τη Ζαβρία έρχεται το χωρίον Αρμενού το οποίο ονομάστηκε έτσι επειδή οι πρώτοι κάτοικοι του ήσαν Αρμένιοι κατελθόντες εξ' Αργυρουπόλεως οι οποίοι αργότερα έφυγαν.

Το Αρμενού είχε πάνω από 100 Ελληνικές οικογένειες κι ένα ωραίο και ευρύχωρο κτίριο ως δημοτικό σχολείο με γραφεία και κατοικίες για τους δασκάλους το οποίο ανήγειρε με ίδιες δαπάνες ο εκ του χωρίου Αρμενού καταγόμενος Γρηγόριος Πανίδης, ηγούμενος της Μονής Περιστερά. Είχε νεόκτιστη εκκλησία (ναό) στο όνομα του Αγίου Γεωργίου και παραπλεύρως ημιερειπωμένο παρεκκλήσι της Αγίας Παρασκευής. Το Αρμενού είχε λιβάδια (παρχάρια) στο Χαλκόλιθον και στο Τζουμαχωτόν όπου φαίνονταν και τα στόμια μεταλλείων.

Προχωρώντας από του Αρμενού συναντάμε στο βάθος κοντά στο ποτάμι το Ελληνικό χωριό Σεϊτανάντων το οποίο είχε 50 οικογένειες, ναό της Γεννήσεως του Ιωάννη του Προδρόμου και Βαπτιστού, δημοτικό σχολείο και βυζαντινό ημιερειπωμένο παρεκκλήσι του Αγίου Ακινδύνου.

Σε μικρή απόσταση απ΄του Σεϊτανάντων βρίσκεται το Γεφύρ λεγόμενον, ήτοι σταθμός των καραβανιών που ακολουθούσαν το σύντομο εαρινό εκ Διποτάμου δρόμο προς την Παϊπούρτη και τα λοιπά εσωτερικά μέρη, ενώ υπήρχαν χάνια και καταστήματα εκατέρωθεν του ποταμού.

Στο Γεφύρ υπήρχε η αστική σχολή της Γαλίανας την οποία ίδρυσαν Παντελίδης ηγούμενος της Μονής του Περιστερά (ο Θεσσαλονίκης) και ο Αρχιμανδρίτης Θεοδόσιος Παντελίδης.

Προχωρώντας απ' το Γεφύρι συναντούμε το χωρίον Κοτύλια̤ το οποίο είχε περίπου 50 Ελληνικές οικογένειες , ναό και δημοτικό σχολείο. Δείτε το σχετικό μας βίντεο για τα Κοτύλια της Χαλδίας του Πόντου, Έναν Κιμισχαναλίδικον Χωρίον

Μετά τα Κοτύλια̤ ακολουθεί το χωρίον Λειβάδια̤ επίσης ελληνικόν στο οποίο κατοικούσαν περι τις 150 οικογένειες. Είχε ναό της Γέννησης του Χριστού και βυζαντινά παρεκκλήσια και δημοτικό σχολείο.

Τα Λιβάδια̤ είναι το τελευταίο χωρίο της Γαλίανας και μετά απ' αυτό αρχίζει δασώδης έκταση ως επί το πλείστον από κλήθρα (παρυδάτιον δέντρον συγγενές της Βελανιδιάς) εκ των οποίων οι κάτοικοι κατασκεύαζαν ξύλινους πίνακες, σκάφες για ζύμωμα και πλύσιμο, ξύλινα κουτάλια, ενώ από άλλα δέντρα όπως από τον πυξόν (τσιμτσίρι) κατασκεύαζαν δοκούς, λικμηστήρια, φτυάρια κτλ. Εκεί στο βάθος του δάσους υπήρχε η Σαϊνκαγια, το καταφύγιο των ανταρτών της Γαλίανας και η Νικάχολα όπου κατασκευάζονταν όλα τα παραπάνω εργαλεία και πινάκια.

Σχετικό τοπικό άσμα αναφέρει : " ΄κ̌ι' ξέρτς κυρά μ' 'κ̌ί' ξέρτς κυρά μ' τον άντραν τιναν είχα ! , εβγαίνεν στην Νικάχολαν εχτίζνεν λεγμερέρα̤, και απάν' ΄ς σα λεγμετέρα̤ εταντάνιζεν τον γέρον".

Οι κάτοικοι των Λειβαδίων έχοντας επικεφαλής τους τον μακαρίτη Ιωάννη Δοξόπουλο ο οποίος ωφέλησε όχι μόνο το χωρίον αλλά και γενικά τη Γαλίανα στις αποφράδες ημέρες, εγκαταστάθηκαν στο Μέγα Ρεύμα κοντά στη Νάουσα όπου διακρίθηκαν για την φιλοπονία και προοδευτικότητα τους.

Πάνω απ τα Κοτύλια̤ και τα Λειβάδια̤ βρίσκεται το Κανλή-ποάρ (ματωμένη βρύση) όπου υπάρχουν χάνια για τα καραβάνια που οδεύουν προς την Παϊπούρτη. Σύμφωνα με την παράδοση πέντε αδερφοί δροσίστηκαν με το κατάψυχρο ύδωρ της πηγής κι έπειτα αναπαύθηκαν. Ήρθαν όμως σε ρήξη και αλληλοεξοντώθηκαν. Έτσι έλαβε η πηγή το όνομα ματωμένη βρύση.

Κατ' άλλους επειδή το νερό ήταν παγωμένο καθώς έβγαινε απ' την πηγή πολλοί διαβάτες που ανέβαιναν προς τα παρχάρια για θεραπεία ενώ έπασχαν από διάφορα νοσήματα πίνοντες ιδρωμένοι το νερό κατελαμβάνοντο από κρίση και απέθαναν.

Το Κανλή-ποάρ είναι μια εκτεταμένη πεδιάδα η οποία ανήκει σε όλα τα χωριά της Γαλίανας, ελληνικά και τουρκικά. Την 29η Αυγούστου εκάστου έτους μαζεύονταν όλοι οι αποφάσιζαν να μοιραστεί σε κάθε χωριό έδαφος για θερισμό των αγελάδων που κατείχαν ή να κατεβούν απ' τα παρχάρια χωρίων και να βόσκουν το χόρτο επι 10 ή 15 ημέρες.

Πάνω απ' το Κανλή-ποάρ υψώνεται απότομο και απόκρημνο όρος με το όνομα Γελέφ του οποίου οι ογκώδεις βράχοι περικλείουν σιδηροπυρίτη. Υπάρχει μάλιστα και μια έκταση περίπου δύο στρεμμάτων όπου ουδέποτε φυτρώνει χόρτο.

Το μέταλλο φαινόταν ακόμα και στην επιφάνεια της γής και μπορούσε κανείς να σπάσει τις πέτρες και να λάβει μικρά τεμάχια εξ' αυτού.

Στο δρόμο που πηγαίνει στο Γελέφ το οποίο χρησίμευε ως παρχάρι του χωρίου Μισαηλάντων και τινών οικογενειών εκ Κοτυλίων και Λειβαδίων φαινόταν πάνω σε

πετρώδη γή αποτύπωμα 4 ποδών βαδίζοντος αλόγου σε μέρος όπου φαίνεται στο βάθος η μονή Περιστερά, ως ιππεύς επί ογκώδους βράχου.

Αναφέρει η παράδοση ότι κάποτε ενέσκηψε πανώλη στη Γαλίανα και στα πέριξ η οποία προξένησε μέγιστη θραύση. Ειδοποιήθηκαν όλοι οι κάτοικοι από την Μονή του Περιστερά να δέονται ορισμένη ημέρα και ώρα είτε ομαδικώς είτε κατά μόνας εις της Υπεραγία Θεοτόκο και τον άγιον Γεώργιον για να τους σώσει από το φοβερό θανατικό.

Μια ημέρα ένας βοσκός έβοσκε τα πρόβατα του σ' εκείνο το μέρος. Ξαφνικά βλέπει καβαλάρη ερχόμενον με βία πάνω στο άσπρο άλογο του ο οποίος και στάθηκε εμπρός του. Με έκπληξη του ο βοσκός είδε ότι τα μπροστινά πόδια του αλόγου βυθίστηκαν στο πετρώδες έδαφος σαν να ήταν πηλός αλλά και τα πίσω πόδια φάνηκαν ομοίως βυθισμένα στο πετρώδες έδαφος.

Ο καβαλάρης τον ρώτησε : Πόσοι καλόγηροι έμειναν στη μονή ; Τρείς απάντησε εκείνος και του ήρθε η ιδέα ότι ο καβαλάρης αυτός είναι ο Άγιος Γεώργιος.

Τον είδε τον Άγιο να πετά από κείνο το μέρος στο βάθος και στάθηκε στην εξώπορτα της μονής. Ακούστηκε τότε μια φοβερή φωνή και έκτοτε έπαυσε η πανώλη από την Γαλίανα και από τη Μονή.

Ο βοσκός είδε τα αποτυπώματα των ποδών του αλόγου στην πέτρα και από τότε ο τόπος ονομάστηκε "Ταγεργή τα πόδας" (τα πόδια τ' Αι-Γιώργη). Συνήθιζαν όσοι έπασχαν από τα πόδια τους να αλείφονται σκόνη μέσα απ' τα αποτυπώματα

αυτά.

Μέσα στην πεδιάδα του Κανλή-ποάρ υπάρχει ένα μέρος ονομαζόμενον "Τη πολέμας το ρακάν" (το βουνό του πολέμου) όπου ως φαίνεται είχε γίνει κάποτε πόλεμος άγνωστον όμως πότε και με ποίους.

Από το Κανλή-ποάρ η οδός προς την Παϊπούρτη (ημιονική) ανεβαίνει οφιοειδώς την απότομη πλευρά του όρους Γελέφ (Καπάν) και προχωρά προς τα παρχάρια παράλληλα με την κορυφογραμμή του όρους φτάνει εις τα Αμπάρια̤ και από κεί εις το Κιμισλή, όπου κείται ύπερθεν της Σάντας και είναι το τελευταίο σύνορο της Γαλίανας με την Σάνταν.

Το Κιμισλή είχε χάνια για τα καραβάνια τα οδεύονται προς μεγάλο ύψος και εκεί παραθέριζαν οι πάσχοντες από διάφορα διότι είχε υγιέστατον κλίμα.

Παρχάρια της Γαλίανας ήσαν :

Το Γελέφ, το Βιντσ̌αστόν, το Ζεμπερέκ όπου βρίσκονται άφθονα καμινεύματα μεταλλείων, το Αρκολίμν' όπου βρίσκεται μικρή λίμνη στην οποία έβαζαν νήματα μάλλινα ή βαμβακερά και μετά από μία εβδομάδα τα έπαιρναν πίσω κατάμαυρα με ανεξίτηλο χρώμα, τα Αμπάρια, τα Κέτσ̌α̤και άλλα.

Στην δυτική πλευρά του όρους της μονής Περιστερά – Πύργου Γελέφ βρίσκεται μόνο του ένα χωριό με το όνομα Κολάχα. Εκεί είχε εύφορα χωράφια η μονή Περιστερά και μετόχι με παρεκκλήσι στο Γεννέσιο της Θεοτόκου. Από κει αρχίζει το δάσος της μονής με πελώριες οξυές με περίμετρο κορμού στα 2-3 μέτρα και ύψος άνω των 30 μέτρων. Κάτω απ τη Μονή φύεται άφθονος πύξος (τσ̌ιμτζίρ') εξ' ου και ο ποταμός κλήθηκε (ονομάστηκε) Πυξίτης. Εκ του δέντρου πύξος κατασκεύαζαν ωραία κοχλιάρια.

Η μονή είναι κτισμένη πάνω σε πελώριο βράχο ενώ στην άλλη πλευρά του όρους βρίσκεται το Αιγιδογόμ' με το πλούσιο χόρτο των λιβαδιών του. Στην αντίπερα της μονής πλευράν του όρους Μούλκ-ταγί βρίσκεται το χωρίον Κουσ̌τιλάντων οι κάτοικοι του οποίου μιλούσαν την γλώσσα των πτηνών. Λέγεται ότι στο χωρίο αυτό άλλοτε συνήθιζαν να ομιλούν ένα ιδίωμα γλώσσας μιμούμενο το κελάηδημα των πτηνών προσθέτοντας σε κάθε συλλαβή των λέξεων παρείσακτον συλλαβήν –τσέ-. Για παράδειγμα για να πούν "έλα" έλεγαν "έ-τσε- λά –τσε" ή να για πούν "λέγε" έλεγαν "λε-τσε – γε-τσε" κι αυτό συνέβαινε για να μη γίνονται αντιληπτοί από τους τούρκους οι οποίοι μιλούσαν επίσης την ελληνικήν.

Το Κουστιλάντων είχε περίπου 60 ελληνικές οικογένειες διεσπαρμένες αλλά και 15 τουρκικές, είχε επίσης ναό αφιερωμένο στον Άγιο Χριστοφόρο και δημοτικό σχολείο.

Απ' το Κουστιλάντων επιστρέφουμε και πάλι στον Διπόταμον και ακολουθούμε τη δυτική πλευρά του όρους Τούφα, η κορυφογραμμή του οποίου φέρει τις ονομασίες : Ράχος, Γουδούλ, Μανόη (Σουρμάνοη).

Στην κορυφή του όρους Τούφα συναντάμε το χωρίον Κουταλά με 80 περίπου ελληνικές απόσταση απ' του Κουταλά υπήρχε το χωρίον Δεμιρτζάντων Γρηγορίου και ένα ερειπωμένο παρεκκλήσι των Αγίων Θεοδώρων Τήρωνος και Στρατηλάτου αλλά και παρεκκλήσι στον Ευαγγελισμό της Θεοτόκου.

Υπήρχαν ακόμα και τα χωρία Παροτάντων και Τζιναλάντων. Πάνω απ' αυτά βρίσκονται αρχαία ερείπια καλούμενα "Καστέλλος" όπου φαίνεται άλλοτε υπήρχε φρούριον. Πάνω απ' το Καστέλλος βρίσκεται το χωρίον Μεσοχώρ' έχον περι τας 80 οθωμανικάς οικίας, ήταν το κέντρο της Γαλίανας όπου κατοικούσαν οι αγάδες του τόπου, οι οποίοι ήδη και στα τελευταία προ του ξεριζωμού χρόνια καλούσαν τους χριστιανούς σε αγγαρείες αλλά με τρόπο φιλικό και έλυνα τις μικροδιαφορές μεταξύ του λαού.

Στο Μεσοχώρ' υπάρχει βυζαντινό παρεκκλήσι ερειπωμένο διασώζων όμως αγιογραφίες το οποίο οι Τούρκοι διετήρησαν ανέπαφο. Συναφές με το Μεσοχώρ' είναι και το χωρίον Ξυλάπα̤ με 20 ανάμεικτες οικογένειες χριστιανών και τούρκων και επίσης με παρεκκλήσι του Αγίου Παντελεήμονος.

Μετά την Ξυλάπα̤ είναι η Βάλαινα η οποία είχε περίπου 100 Ελληνικές οικογένειες, ναό στο όνομα του Αγίου Ιωάννη και δημοτικό σχολείο. Η άνωθεν του χωρίου Βάλαινα απότομη και ψηλή κορυφογραμμή ονομάζεται Γουδούλ' όπου υπάρχουν πολλά παλιά ερείπια, ίσως αλλοτινό φρούριο ( Tου Γουδουλά ο Κάστρον ).

Κάτωθεν της Βάλαινας υπάρχει το χωρίον Τσουπανού το οποίο είχε 60 περίπου Ελληνικές οικογένειες, ναό της Μεταμορφώσεως του Σωτήρος και δημοτικό σχολείο.

Εδώ τελειώνουν τα χωρία της Γαλίανας.

Οι κάτοικοι της Γαλίανας λόγω της στενότητος του τόπου, ταξίδευαν στη Ρωσία και την Κωνσταντινούπολη, εργάζονταν στην Τραπεζούντα ή διαμένοντες εκεί μονίμως ησχολούντο με την γεωργία και κτηνοτροφία ζώντας μετά δυσκολίας.

Πηγές - βοηθήματα :

1. Ποντιακή Εστία τεύχος 7ον &10ον Αθήναι 1950

2. Σάββα Ιωαννίδη "Ιστορία και Στατιστική Τραπεζούντος" (1870)

3. Επίτομον λεξικόν της αρχαίας Ελληνικής Γλώσσης Π.Χ. Δορμπαράκη

4. Αγιολόγιον της Ορθοδοξίας Χρήστου Δ. Τσολακίδη